Expansion of claims severity has continued to impact the medical community.

But what is driving these rising claim costs? This report explores some of the factors leading to the surge in indemnity and how Physicians Insurance works to mitigate the impact these trends have upon our Members.

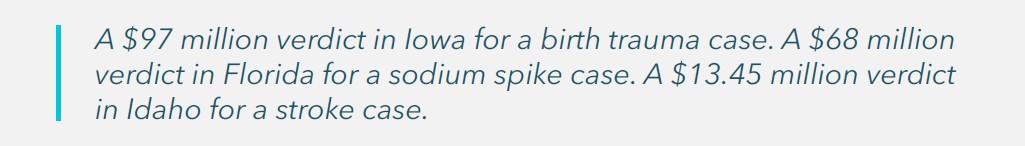

Across the United States—and even in traditionally conservative venues—nuclear verdicts continue to make headlines. Industry-wide from 2017 to 2019, there were a record number of $25 million–plus medical malpractice verdicts. Although mega-verdicts slowed during the pandemic due to courts closing and/or the prioritization of criminal matters, the backlog is now being cleared, and numbers are already exceeding pre-pandemic levels.

Verdict data compiled by the international reinsurer TransRe showed that as of September 30, 2023, the industry saw nearly double the number of $25 million–plus verdicts this year versus the same time last year, putting the industry on pace to break verdict records yet again. (TransRe, 2023)

As a company, we have not been immune to the trend of rising claims severity. At Physicians Insurance, our average paid indemnity on closed claims and lawsuits from 2018 to 2022 increased 37% as compared with the prior five-year period. Some specialties, including Emergency Medicine and Neurosurgery, saw increases of more than 60% during that same timeframe, while average paid indemnity for claims against the entity increased 84%.

This expansion of claims severity has continued to impact the entire medical community. But what is driving this trend? The following explores the factors that lead to surging indemnities and how Physicians Insurance is working to protect, defend, and support our Members in the face of these challenging trends.

Medical Liability Trends

Social Inflation

Even before the country was grappling with record high economic inflation, the insurance industry was tracking the rise of social inflation. This term refers to the rising costs of claims due to changing societal expectations. Factors driving this trend include distrust of corporations, juror compositions, and plaintiff attorney strategies.

Since the pandemic, we have seen an erosion of trust in any authoritative system or system that cares for others. As a result, plaintiff attorneys have moved to only name the healthcare entity as the defendant instead of individual providers, in order to take advantage of the public’s mistrust of corporations.

Changing demographics have tipped the resulting jury pool toward a much younger population. These younger juries are influenced by skyrocketing rent and home prices, uncertainty of access to future medical insurance, and a perceived notion that someone needs to pay when an adverse result occurs.

Post-pandemic, there has been an increase in political polarization with a general mistrust of objective facts. Polling from juries shows that jurors feel physicians should test for all possible conditions or problems a patient may have and be told of all possible risks for treatment, no matter how rare. Modern juries increasingly have the perception that all negative outcomes are the result of a mistake. Recently, a plaintiff attorney stated to a jury, “They [the defense] will tell you that their conduct met the standard of care. Their standard of care killed this patient.”

Erosion of Tort Reform

Tort-reform erosion has a complex effect on the medical professional liability industry. For nearly 50 years, California’s Medical Injury Compensation Reform Act (MICRA) served as a national model for tort-reform liability for other states. A key provision of this law included capping noneconomic damages at $250,000. In 2022, after years of attacks from the plaintiff’s bar and several close ballot initiatives to overturn it, key stakeholders agreed on a compromise to modify MICRA by increasing non-economic caps over 10 years from $250,000 to $1,000,000 for wrongful death and $750,000 for all other claims, with 2% increases to these caps post-2033. The net result is that even for states that have a cap in place, the floor has been moved to $750,000 or more with annual increases for inflation. For states with no cap in place, there is little to no appetite from voters or state legislators to implement one.

Through our in-house lobbyist, we support comprehensive legislation that improves the healthcare liability system, promotes meaningful patient-safety initiatives, and improves healthcare quality.

Contribution Actions Against Physicians

To capitalize on the public’s mistrust of corporations, plaintiff attorneys are increasingly employing the tactic of only suing corporate defendants. This means that the care of an individual physician may be at issue, even though they are not a named defendant in the complaint. Corporate defendants, seeking to reduce their exposure, may settle the lawsuit early and then bring a contribution claim against the physician, even though the physician had no say in the decision to settle or the settlement amount.

Accordingly, Physicians Insurance’s broad coverage includes claims and potential claims that may be brought against physicians. We encourage the reporting of potential claims so we can work with our Members to mitigate possible future risk. This can include paying for defense-attorney and expert-witness fees even before a claim is ever made and in lawsuits in which a physician may not be named but whose care is at issue. This coverage trigger reinforces Physicians Insurance’s proactive approach in helping our Members get ahead of litigation and avoid costly contribution claims that may be brought by co-defendants later.

Litigation Funding

Medical malpractice litigation can be expensive for both plaintiffs and the defense. However, a relatively new trend in the United States that enables prosecuting medical negligence cases is third-party litigation financing. This form of financing involves plaintiffs contracting with third-party funders for financial assistance in exchange for an interest in the potential recovery. The agreement is usually non-recourse, so if the plaintiff loses the case, the funder receives nothing.

Litigation funding is growing significantly in the United States, reaching an estimated market value of $13.5 billion last year. Litigation financing is controversial, as it can increase the number of cases brought—particularly weak ones—prolong litigation and discourage settlement, and direct money away from the injured party (given that a large percentage of a verdict will go to the investor and attorneys). Being a relatively new financial tool, it’s largely unregulated.

Due to the potential impact of this practice on our Members, Physicians Insurance is closely monitoring the trend in litigation financing and working with defense counsel to identify cases involving third-party funding early in the discovery process. Nationally, we are working with our partners to promote model legislation that would regulate litigation funding in various states where no regulation currently exists.

Criminalization of Medicine

The already challenging environment for physicians has been made even more difficult by the trend towards the criminalization of medicine, as seen in recent high-profile cases. Compounding the situation is the potential for criminal state claims arising out of the U.S. Supreme Court’s Dobbs decision, including from practices that have long been the professionally accepted standard of care.

To protect our Members against this trend, Physicians Insurance launched an industry-first Criminal Defense Reimbursement Coverage. While medical professional liability policies have historically excluded coverage for criminal actions, Physicians Insurance’s Criminal Defense Reimbursement Coverage expressly responds to reimburse defense costs up to $250,000 (without eroding the limits of the main policy) when criminal actions arise from direct patient care.

Our policy form continues to offer broad coverage, providing solutions for a wide range of circumstances—and this new endorsement only enhances our offerings.

Targeted Specialties for Plaintiff Attorneys

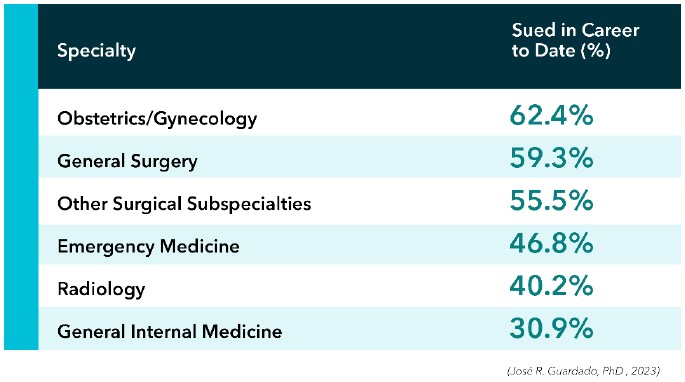

While physicians of all specialties are experiencing the impact of the trends noted above, certain specialties are frequent targets of lawsuits. A recent survey conducted by the AMA evaluated medical liability claim trends, including frequency by specialty. Consistent with our experience, their findings noted that “General surgeons, other surgeons, OB/GYNs, orthopedic surgeons, radiologists, and emergency medicine physicians are the specialties whose physicians are significantly more likely to have been sued recently than general internists (the reference group).”

General themes of cases inherent to these specialties can make them appealing targets for plaintiff attorneys.

By their very nature, surgical specialties can lead to high-severity injuries, even absent any negligence on the part of the physician. Obstetrical cases have the added difficulty of a very sympathetic situation for both parents and baby. General surgery cases often involve surgical misadventures, in many instances with the surgery itself being defensible but with the patient developing complications such as septic shock post-surgery, leading to questions regarding recognition and treatment. Neurosurgery cases, by their very specialized nature, can lead to intraoperative injuries such as post-operative bleeds that become a hematoma or cause paralysis. Trauma surgeons, already dealing with high-acuity injuries, may be sued for expected complications even in situations in which their treatment saves the life of the patient but the patient is left with some kind of impairment and thus blames the physician.

Emergency Medicine cases are often catastrophic, with common cases involving stroke, chest pain that becomes a myocardial infarction, and cases related to infection (meningitis, bacterial, septic shock). Plaintiff attorneys will dial back the treatment several days to when the patient was at the emergency room, using hindsight to say that any presentation should have alerted the ED physician to make different decisions that plaintiff attorneys claim would have averted or minimized the injury to the patient. Hindsight can make it easy for plaintiffs to argue that what would ordinarily be an unnecessary test or admission in their instance was medically necessary, despite not being the generally accepted standard of care.

For radiologists, high volumes of reads combined with the demand for quick results are at odds with the public perception that radiologists should always take extra time and call the referring physician with any abnormal finding. Hindsight bias is high, with juries feeling that anything missed is presumed to be a violation of the standard of care. High-damages cases such as those involving stroke, cancer, or pulmonary embolism are particularly enticing for plaintiff attorneys, as they can show juries images of alleged missed reads. Even failure to diagnose lung cancer cases—once seen as unappealing, since juries tended to blame smokers—are now being filed with greater frequency if plaintiffs think a radiologist could have diagnosed an issue sooner.

Protecting, Defending, and Supporting Members

Rigorous Claims Defense

Despite the challenging current legal environment, our claims team’s deep understanding of local defense and plaintiff counsel and judicial environments, along with our strong local relationships and resources, have resulted in a 10-year average of over 97.6% of jury trials resulting in defense verdicts.

Our claims team thoroughly investigate each case for our Members. We rigorously defend good medicine, resolve meritorious claims in a timely manner, and bring to bear all of the resources needed to protect our Members—including utilizing multiple experts, focus groups, and witness and jury consultants—as cases warrant, while also providing all-important litigation peer support for policyholders. Our caseload per adjuster is substantially below the industry average, ensuring an exceptional focus on each claim. When it comes to defending good medicine, we stand by our Members and will not hesitate to go to trial when we need to—even if the cost of settlement would have been less than the cost of defense.

Expansion of Risk Services

The professionals in our risk-management department, known for their customized services, continue to provide our Members with the risk services they need for today’s dynamic environment, embracing a vast array of virtual tools to complement onsite offerings. New resources developed in the past year include specialty-specific risk-assessment tools for Diagnostic Imaging, Emergency Medicine, Surgical Services, Outpatient Behavior Health, and Inpatient Pediatrics. Staying on top of emerging risks, our team also developed guidance documents on Artificial Intelligence and Wearable Device Technology in Healthcare.

Risk consultants continue to deliver custom, onsite education to Members with recent offerings including training on documentation, risk management fundamentals, and peer review. The department recently added several new courses to the Risk Management Resource Library related to opioid treatment and management. This action was initiated to support our Members in complying with the recent mandate by the Drug Enforcement Administration (DEA), which requires all DEA-registered practitioners to complete eight hours of training related to the treatment and management of patients with opioid and other substance-use disorders. Our online library additionally contains continuing education for healthcare professionals pertaining to cultural competency and implicit bias, which is required by many states as a condition of licensure.

Legislative and Regulatory Advocacy

Physicians Insurance has a long history of advocacy with legislative issues that impact liability for our Members. Our Senior Director of Government Relations has over 30 years of experience leading and providing national and state government relations.

Nationally, we worked to promote bipartisan support of the Good Samaritan Liability Protection Act (HR 2819) in the reauthorization of the Pandemic and All Hazards Preparedness Act (PAHPA). This legislation would provide the same immunity from liability protection language as passed in the CARES Act but not limited to Covid-19. We made notable progress in promoting national legislative proposals that address telemedicine liability as telemedicine services continue to expand, and we protected reasonable cybersecurity and data privacy relating to the Health Insurance Portability and Accountability Act (HIPAA).

Notable recent achievements at the state level include defeating proposals to allow punitive or exemplary damages and expanding beneficiaries for wrongful death in Washington. In Oregon, we protected the $500,000 cap on noneconomic damages recoverable in wrongful death actions and defeated legislation to provide for a private right of action in data privacy and other various qui tam proposals. In Idaho, we supported proposals that accurately represent medical expenses in personal injury medical claims and that strengthen the interpretation and application of the cap on noneconomic damages.

Prioritizing Our Members

Physicians Insurance A Mutual Company strives to embody our purpose and values in everything we do. Recognizing this, in 2022 our leadership collectively stepped back to contemplate what we have done over the past 40 years—and how we can best be there for our Members in the years to come. As a result, we redefined our organization’s core purpose against the backdrop of today’s increasingly difficult healthcare environment, and together have agreed for all of us at Physicians Insurance to embrace a singular mission: to protect, defend, and support our Members. With this refocused energy on our purpose and core values, we have updated how our brand is presented in the marketplace, emphasizing our dedication to our reason for being.

The Physicians Insurance difference stems from who we are as a mutual insurance company—we are owned by and accountable to our Members. Unconcerned about shareholders or quarterly analyst calls, we are wholly focused on protecting, defending, and serving our Members. That’s why we steward our Member premiums toward the things that matter most. We provide the resources needed to provide a rigorous defense, from hiring jury consultants to national experts, all to get the best results for our Members. These investments show up in our results. Relative to 33 of our peer companies, Physicians Insurance is in the top quartile for spending on claims, yet in the bottom quartile for what we spend on ourselves, maintaining tight expense management so our focus remains on our Members.

Maintaining Our Strength

Our financial stability is the underpinning of our purpose, enabling everything we do for our Members. Cognizant of changing market dynamics, loss-cost inflation and lack of meaningful tort reform, we remain steadfast in our commitment to providing best-in-class services and claims management to our Members. We achieve this through a responsible and sustainable pricing approach that reflects the underlying risk, while maintaining our mutual mindset.

In Your Corner

For more than 40 years, Physicians Insurance has remained steadfast in our commitment to protect, defend, and support physicians with the best insurance coverages available, superior claims servicing, unparalleled risk-management resources, and an emphasis on always putting our Members first. Our job is to protect our Members as they pursue their life’s work.

1 Guardado JR. “Policy Research Perspectives: Medical Liability Claim Frequency Among U.S. Physicians.” American Medical Association. (2023.) Accessed at: chrome-extension: //efaidnbmnnnibpcajpcglclefindmkaj/https://www.ama-assn.org/system/files/policy-research-perspective-medic…