MedChoice provides your evolving practice, clinic, or hospital with a new alternative to traditional liability programs. For those medical businesses that want more control but aren't ready to fund, start, and run their own Captive, MedChoice provides an adaptive step toward that goal. MedChoice is rated A- Excellent by AM Best.

MedChoice provides your evolving practice, clinic, or hospital with a new alternative to traditional liability programs. For those medical businesses that want more control but aren't ready to fund, start, and run their own Captive, MedChoice provides an adaptive step toward that goal. MedChoice is rated A- Excellent by AM Best.

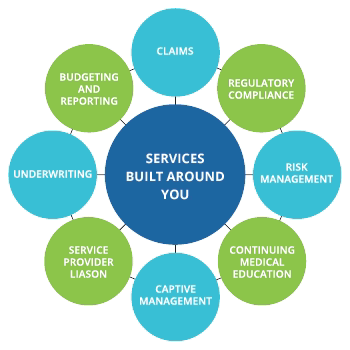

MedChoice Risk Retention Group, Inc. is a national insurance company licensed in Vermont under the Federal Risk Retention Act. As a niche RRG, MedChoice provides specialized medical professional liability and casualty coverages, products, and services built to meet the specific needs of specialties or groups. Though an independent entity with separate governance and owned by its policyholders, MedChoice is reinsured 95%, and operated by Physicians Insurance A Mutual Company (PI) through the PI family of companies.

Nevada Docs Support Association (Nevada Docs)

Nevada Docs Support Association (Nevada Docs) serves the Nevada medical professional liability insurance needs for hundreds of doctors throughout the State of Nevada, including Las Vegas and Reno. Founded in 2006, Nevada Docs also provides members access to its group purchasing program helping its members and their employees save on personal, office, and medical supplies. In November 2015, Nevada Docs formed a partnership with MedChoice RRG to provide single- and multi-specialty practices medical professional liability coverage, risk management, continuing medical education, and claims administration. The support from Nevada Docs, along with the financial strength and breadth of services offered through MedChoice RRG, is a winning combination for Nevada's physicians and practices.

Nevada Docs Support Association (Nevada Docs) serves the Nevada medical professional liability insurance needs for hundreds of doctors throughout the State of Nevada, including Las Vegas and Reno. Founded in 2006, Nevada Docs also provides members access to its group purchasing program helping its members and their employees save on personal, office, and medical supplies. In November 2015, Nevada Docs formed a partnership with MedChoice RRG to provide single- and multi-specialty practices medical professional liability coverage, risk management, continuing medical education, and claims administration. The support from Nevada Docs, along with the financial strength and breadth of services offered through MedChoice RRG, is a winning combination for Nevada's physicians and practices.

Alterna, wholly owned and operated by Physicians Insurance, focuses on providing alternative risk solutions, management, and services to maximize any and all insurance-related benefits. Our team combines deep liability insurance expertise with proven hands-on experience in analyzing, creating, developing, and managing group, captive, risk retention group, and other insurance facilities.

We understand the need for specialized captive expertise and offer alternative risk solution financing and management services to support the evolution of complex business models. Today, our capabilities support the creation, management, and support for all types of captives.

Currently, we manage captives across the country, across multiple lines, including Commercial Liability, Cyber, Medical Professional Liability, and Property. Being highly selective of the types of captives we manage enables us to deliver superior service, responsiveness, and customization ensuring we’ve built a solution around the specific needs of our clients.

Alterna, wholly owned and operated by Physicians Insurance, focuses on providing alternative risk solutions, management, and services to maximize any and all insurance-related benefits. Our team combines deep liability insurance expertise with proven hands-on experience in analyzing, creating, developing, and managing group, captive, risk retention group, and other insurance facilities.

Creating and launching a captive with diverse risk types is complex. There may be portions of the risk that are better suited to captive structures in a hard market, or vice versa. A feasibility study enable you to best identify these risks and its overall tolerance for loss in the event of adverse performance.

After a feasibility study is completed, domicile selected and captive structure determined, there are generally additional steps to licensing a captive insurance normally requiring, on average, up to 45-60 days from start to completion.